vermont sales tax exemption certificate

You can download a PDF of the Vermont Streamlined Sales Tax Certificate of Exemption Form SST on this page. Submit a completed Certification of Tax Exemption form VT-014 with a completed Registration or Tax Title.

Exempt from sales tax on purchases of tangible personal property and meals not rooms.

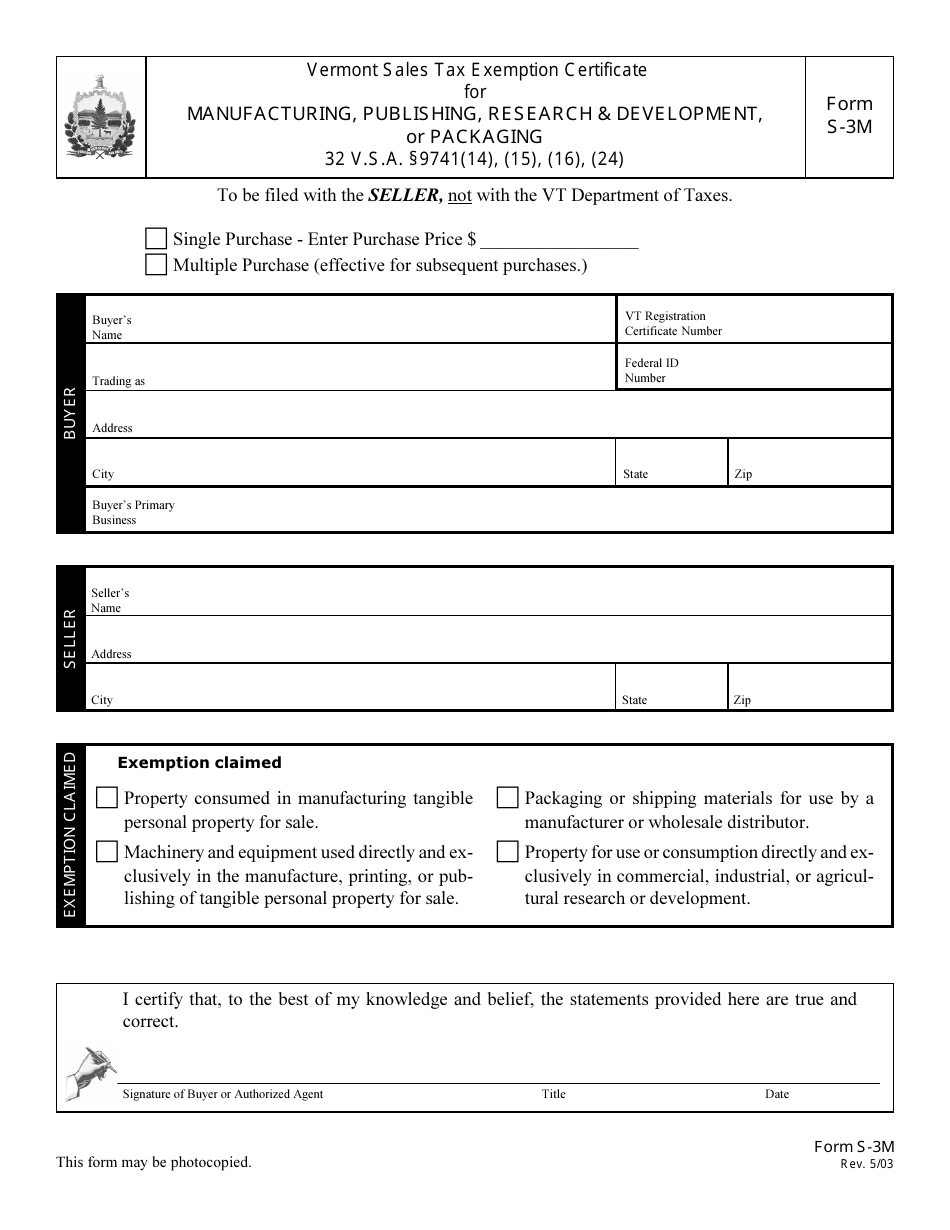

. Certification is on an exemption form issued by the Vermont Department of Taxes The. Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now. S-3M Vermont Sales Tax Exemption Certificate For Manufacturing Publishing Research Development or Packaging.

Ad New State Sales Tax Registration. Check out the rest of this guide to determine who needs a sales tax permit what. For other Vermont sales tax exemption certificates go here.

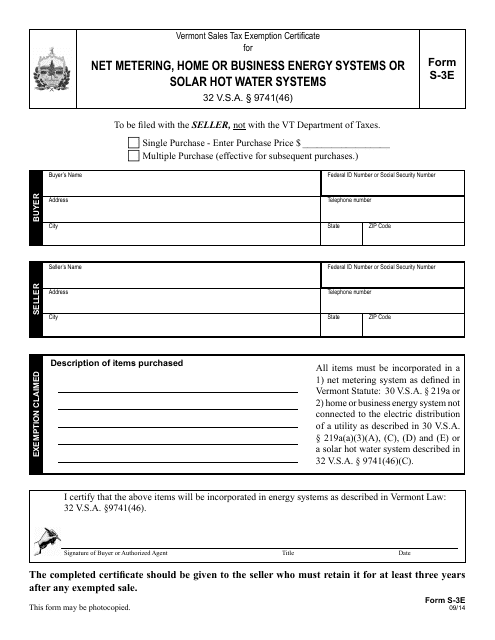

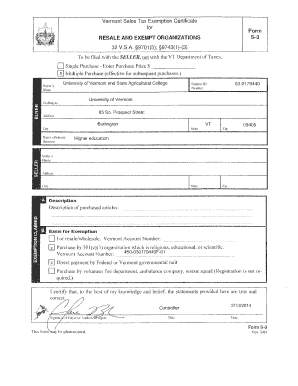

45 rows Vermont Sales Tax Exemption Certificate For Fuel or Electricity. STATE OF VERMONT DEPARTMENT OF TAXES 109 STATE STREET MONTPELIER VERMONT 05609-1401 RESALE AND EXEMPT ORGANIZATION CERTIFICATE OF EXEMPTION TITLE 32 97075. Other types of exemption certificates that may be applicable are available on our website at.

Business and Corporate Exemption Sales and Use Tax. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Open the doc and select the page that needs to be signed.

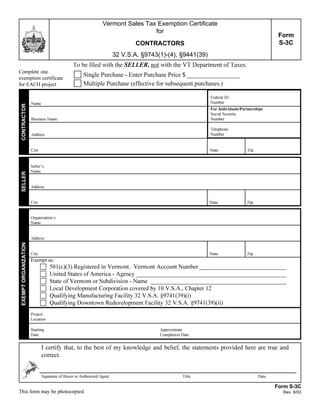

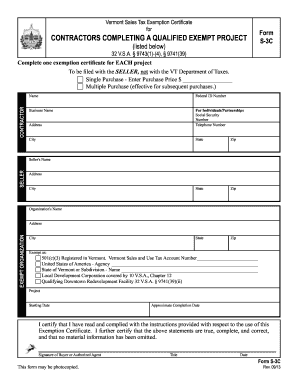

S-3T Vermont Sales Tax Exemption Certificate for Purchases of Toothbrushes Floss and Similar Items of Nominal Value to be Given to Patients for Treatment. 803 Vermont Sales Tax Exemption Certificate for CONTRACTORS 32 VSA. Download or Email VT S-3M More Fillable Forms Register and Subscribe Now.

Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit. Certificate contains no statement or entry which the seller knows or has reason to The know is false or misleading. An exemption certificate is received at the time of sale in good faith when all of the following conditions are met.

Vermont Sales Tax Exemption Certificate information registration support. Multiple Purchases - Description of purchased articles. For other Vermont sales tax exemption certificates go here.

Search for the document you need to design on your device and upload it. 97431-4 944139 ˇ. An example of an item that is exempt from Vermont sales tax are items which were specifically purchased for resale.

How to use sales tax exemption certificates in Vermont. Sales Tax Exemptions in Vermont. 97431-3 Suppliers Name Street City Town or PO State and Zip Single Purchase - Enter Purchase Price.

This exemption certificate applies to the following. View a list of available meals and rooms tax exemptions and exemption certificates. Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing.

S-3pdf 8943 KB File Format. In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. For questions regarding how these exemption certificates may be properly applied please contact the Vermont Department of Taxes at 802 828-2551 option 3.

With a Vermont Sales Tax Permit youll obtain a Sales Use Tax Account Number for use when filling out the resale certificate. Form S-3M Vermont Sales Tax Exemption Certificate For Manufacturing Publishing Research Development Or Packaging 3095 KB File Format. The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax. If you dont have an account yet register. The Sales Tax Permit allows you to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows you to make tax-exempt purchases for products intended for resale.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax. S-3V Vermont Sales Tax. Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now.

You will be required to prove that the vehicle was registered in a qualifying jurisdiction for at least 3 years. You can download a PDF of the Vermont Streamlined Sales Tax Certificate of Exemption Multistate Form SST-MULTI on this page. Provide vendor with completed Sales Tax Exempt Purchaser Certificate Form ST-5 PDF and copy of Form ST-2 Certificate of Exemption PDF with Renewal Notice Exemption No.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. You may claim a tax credit for a vehicle registered to you for a period of 3 years or more in a jurisdiction that imposes a state sales or use tax on vehicles. Vermont Sales Tax Exemption Certificate for Form 32 VSA.

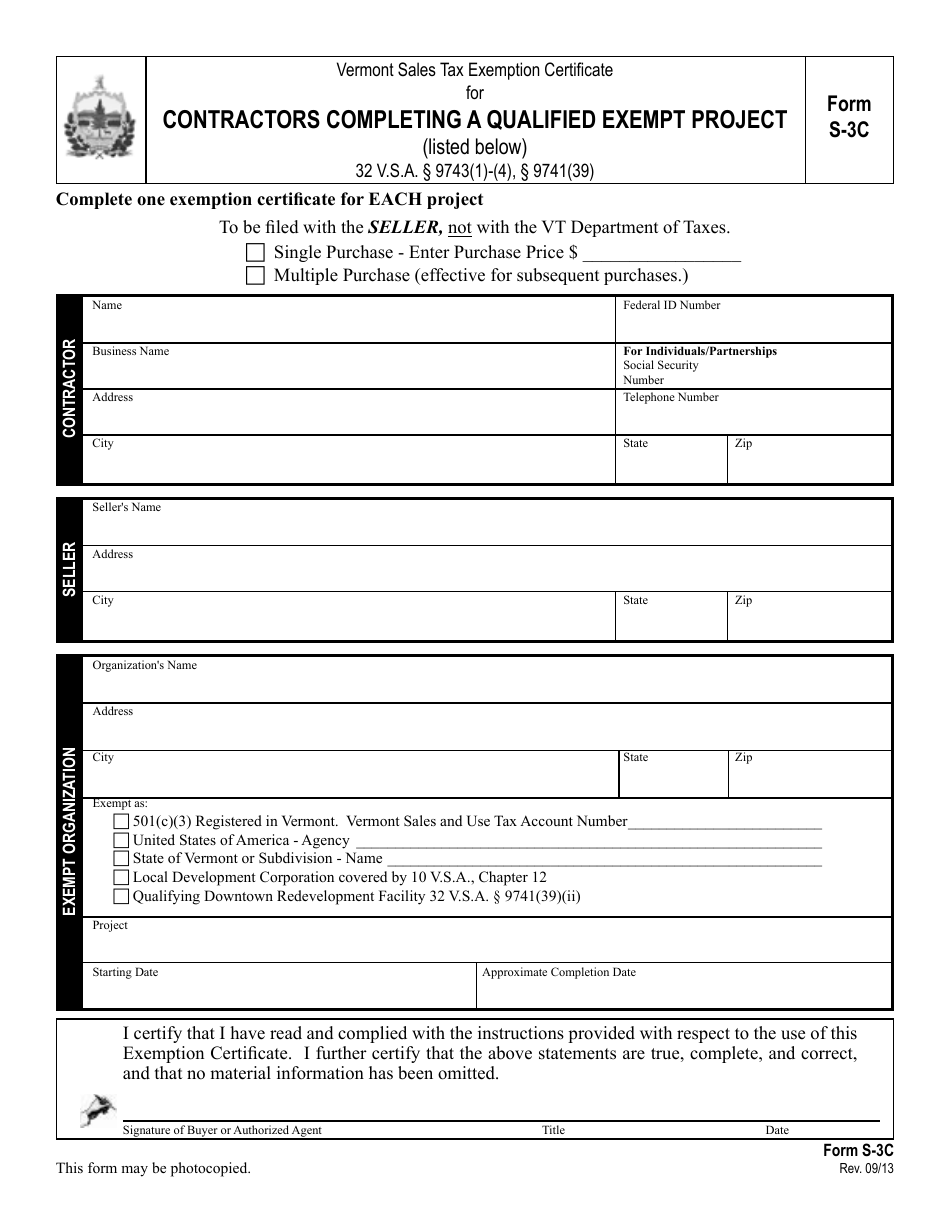

Get vermont sales tax exemption form signed right from your smartphone using these six tips. ˇ ˆ Form S-3C Rev. Exemption certificates are not filed with the Vermont Department of Taxes but the seller must produce an exemption certificate when it is requested by the Department.

A Vermont Certificate of Exemption is a document that allows a business to purchase goods and services tax-free from suppliers for the purpose of reselling those goods and services. Business and Corporate Exemption Sales and Use Tax. The certificate is also sometimes referred to as a resale permit or a resellers permit.

Vermont Sales Tax Exemption Certificate for CONTRACTORS 32 VSA. No exemption from separate MA room occupancy excise tax.

Vt Form S 3m Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Manufacturing Publishing Research Development Or Packaging Vermont Templateroller

Declaration Of Income Dance Studio Development Dance Studio California

Requirements For Tax Exemption Tax Exempt Organizations

Fillable Online Vermont Sales Tax Exemption Certificate For Form Resale Fax Email Print Pdffiller

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Fillable Vermont Sales And Use Certificate Fill Out And Sign Printable Pdf Template Signnow

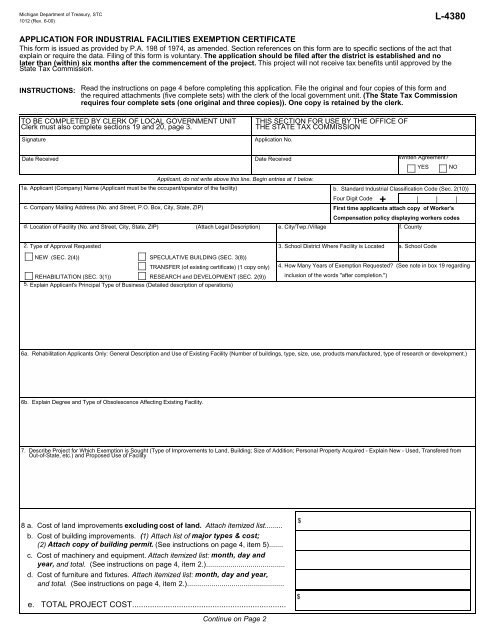

Form 1012 Application For Industrial Facilities Exemption Certificate

Vermont Sales Tax Exemption Certificate For Form S

Printable Vermont Sales Tax Exemption Certificates

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com